This analysis uses data on CMHC insured homeowner mortgages to examine the deferral duration. We define “deferral duration” as the length of time a mortgage has been, or is expected to be in deferral.

Highlight of findings

- For mortgages deferred between March and September 2020, a 6-month deferral was the most common arrangement.

- By the end of September 2020, 64.7% of the deferred mortgages had exited the deferral stage. Of these, 67.3% exited on schedule, and 32.7% exited early.

- For the mortgages still in active deferral as at September 30, 2020, 85.1% were scheduled to expire in October 2020. Another 9.0% were scheduled to expire by the end of December 2020.

- As the deferral option expires, the risk of these mortgages entering arrears re-emerges. The outcomes will depend on many factors and will continue to be monitored.

View definitions of terms used in this article

Over a quarter million CMHC-insured homeowner mortgages were deferred at some point between March and September 2020. When applying for payment deferrals, borrowers are granted a period of time during which regular mortgage payments are suspended. The typical deferral period ranges from 1 to 6 months.

Borrowers are expected to resume payments after the deferral period ends. Some borrowers may not use the entire deferral period. Others might ask for an extension in order to continue payment deferral. We discuss these effects and provide terminology to help you understand of the terms used.

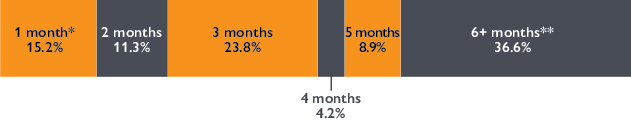

Six-month deferral period was the most common arrangement in deferral applications

When first applying for a deferral, a 6-month deferral was the most common arrangement, followed by a 3-month deferral. This period is the length of time for which borrowers are expected to defer their mortgage payments. On average, a borrower would defer payments for 4 months. Figure 1 shows the distribution of mortgages across the expected deferral durations.1

After reaching the end of the initial deferral period, 17.2% of the borrowers selected the option to defer payments further. These reoccurring deferrals increased the average expected deferral duration by about 12 days.

Figure 1. Distribution of expected deferral duration

Expected deferral duration, initial deferral period

Expected deferral duration, including extensions

| Expected duration | Initial deferral period | Including extensions |

|---|---|---|

| 1 month* | 15.2% | 12.5% |

| 2 months | 11.3% | 8.0% |

| 3 months | 23.8% | 18.6% |

| 4 months | 4.2% | 5.5% |

| 5 months | 8.9% | 13.0% |

| 6 months** | 36.6% | 42.4% |

| Total | 100.0% | 100.0% |

* This includes “less than 1 month” (around 2%).

** This includes “over 6 months” (around 1%).

Source: CMHC

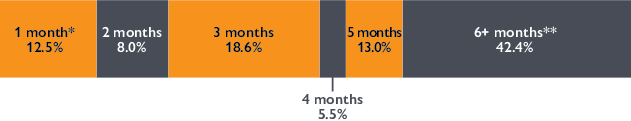

Among the reoccurring deferrals, 52.2% of the borrowers extended the deferral period by 3 months. Another 24.5% of the borrowers extended the deferral period by 2 months, and 12.9% by 4 months. This increased the expected deferral duration of these mortgages from 1 to 3 months to 4 to 6 months (figure 2).

Figure 2. Distribution of expected deferral duration, reoccurring deferrals only

| Expected duration | Initial deferral period | Including extensions |

|---|---|---|

| 1 month | 23.5% | 0.2% |

| 2 months | 27.7% | 0.6% |

| 3 months | 43.9% | 0.9% |

| 4 months | 4.9% | 16.3% |

| 5 months | 35.1% | |

| 6 months* | 46.9% | |

| Total | 100.0% | 100.0% |

* This includes “over 6 months” (around 4%).

Source: CMHC

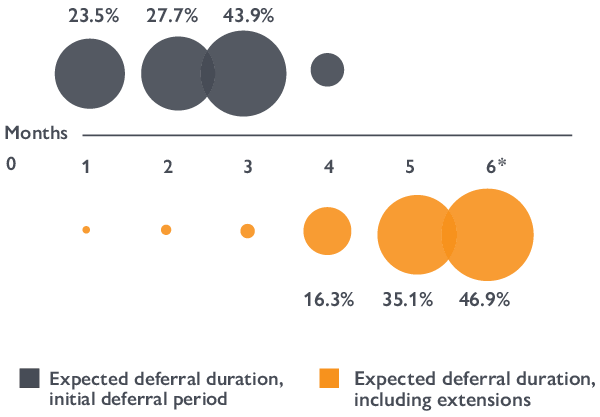

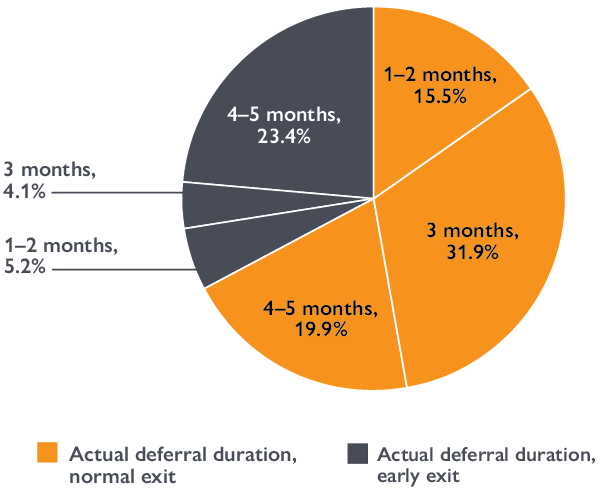

Actual deferral duration of early-exit deferrals was on average longer than that of normal-exit deferrals

By the end of September, 64.7% of the deferred mortgages were no longer in deferral. Possible reasons for this include that the borrower expected to resume payments or that the property was sold. We examined how long these borrowers used the deferral option.

On average, borrowers deferred mortgage payments for 3.5 months before exiting the deferral stage. A normal exit is when the deferral terminates at the end of the granted deferral period. An early exit is when the borrower chooses to stop the payment deferral before the end of the approved deferral period. Among the terminated deferrals, 67.3% were normal exits, and 32.7% early exits. Of the early exits, 78% ended 1 month before the end of the granted deferral period.

Borrowers who applied for a longer deferral period were more likely to terminate the arrangement ahead of schedule. The average expected deferral duration was 6 months for the early-exit deferrals, and 3 months for the normal-exit deferrals. The average actual deferral duration was 4 months for the early-exit deferrals, and 3 months for the normal-exit deferrals.

Figure 3. Distribution of actual deferral duration

| Actual duration | Normal exit | Early exit |

|---|---|---|

| 1 month | 7.3% | 1.0% |

| 2 months | 15.7% | 14.9% |

| 3 months | 47.5% | 12.6% |

| 4 months | 8.6% | 14.0% |

| 5 months | 20.9% | 57.5% |

| Total | 100.0% | 100.0% |

Source: CMHC

The majority of the deferrals were expected to finish by the end of 2020

At the end of September 2020, 35.3% of all deferred mortgages were still active. Among them:

- 85.1% were scheduled to expire in October 2020

- another 9.0% by the end of December 2020

- the remaining 5.9% in 2021

Table 1 is a termination schedule representing the number of mortgages that are expected to exit deferrals. The numbers are normalized to 100 active deferrals as at September 30, 2020.

| Sept. 2020* | Oct. 2020 | Dec. 2020 | 2021 | |

|---|---|---|---|---|

| One-time deferrals | 81 | 68 | 8 | 5 |

| Reoccurring deferrals | 19 | 17 | 1 | 1 |

| Total termination in period | 100 | 85 | 9 | 6 |

| Active at end of period | 15 | 6 | 0 |

* This column is the remaining active deferrals as at September 30, 2020.

Source: CMHC

As deferral options expire, the risk of these mortgages entering arrears re-emerges. The outcomes depend on many factors and will continue to be monitored.

Terminology

- Expected deferral duration:

- The length of time for which a mortgage is approved for payment deferral.

- Actual deferral duration:

- The length of time a deferral option has been used.

- Normal exit:

- A mortgage exits the deferral stage as scheduled.

- Early exit:

- A mortgage exits the deferral stage before the scheduled termination.

- One-time deferral:

- The mortgage is deferred once and the deferral period is not extended.

- Reoccurring deferral:

- The deferral period is extended beyond the period initially applied for.

Footnotes

- About 2% of the deferred mortgages reported a 0 value for the number of months deferred. We interpret the 0 value as a deferral duration less than 1 month. In the graph, the deferral duration of 1 month includes 1 month or less (reported as 0). About 1% of the deferred mortgages reported a value greater than 6 for the number of months deferred. It is included in the deferral duration of 6 months in the graph.

Share via Email

Share via Email