This analysis examines deferrals of insured and uninsured residential mortgages. The data is from the credit rating agency Equifax Canada, and is as reported to that agency.1 The data covers approximately 80% to 85% of the Canadian market for residential mortgages and includes both insured and uninsured mortgages.

Highlight of findings

- Payment deferrals on consumer debt peaked in June 2020. At that time, 18.7% of the insured and 15.9% of the uninsured mortgage balance was in deferral.

- Of the mortgage balance in deferral, 33.8% was insured, and 66.2% uninsured. The average loan size of uninsured mortgages in deferral was about $35,000 higher than the average for insured mortgages.

- Some consumers who deferred mortgages also deferred other consumer debt, such as credit cards and HELOCs.

- As at March 31, 2021, deferred mortgage and non-mortgage consumer debt had decreased by over 95% from its peak in June 2020.

Since the beginning of the COVID-19 pandemic, payment deferrals on consumer debt peaked in June 2020. As at June 30, 2020, the following mortgage balances were in deferral:

- 18.7% insured

- 15.9% uninsured

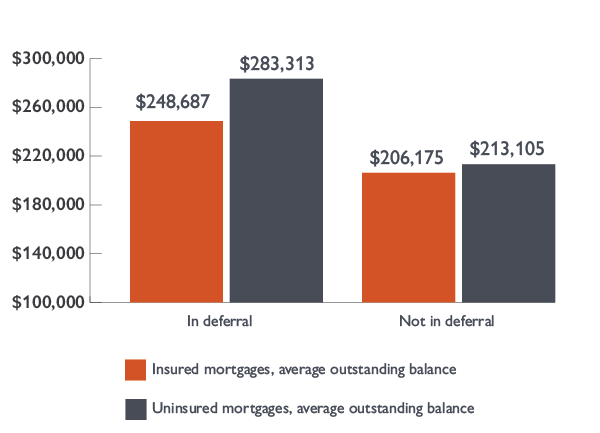

Of the mortgage balance in deferral, 33.8% was insured and 66.2% uninsured. In figure 1,

- the average outstanding balance of insured mortgages in deferral was $248,687. This was 20.6% higher than the average balance of insured mortgages that were not in deferral.

- the average outstanding balance of uninsured mortgages in deferral was $283,313. This was 32.9% higher than the average balance of uninsured mortgages that were not in deferral.

Figure 1. Average outstanding balance of mortgages in deferral was higher than those not in deferral

| In deferral | Not in deferral | |

|---|---|---|

| Insured mortgages (average outstanding balance) | $248,687 | $206,175 |

| Uninsured mortgages (average outstanding balance) | $283,313 | $213,105 |

Source: CMHC calculations using Equifax Canada data

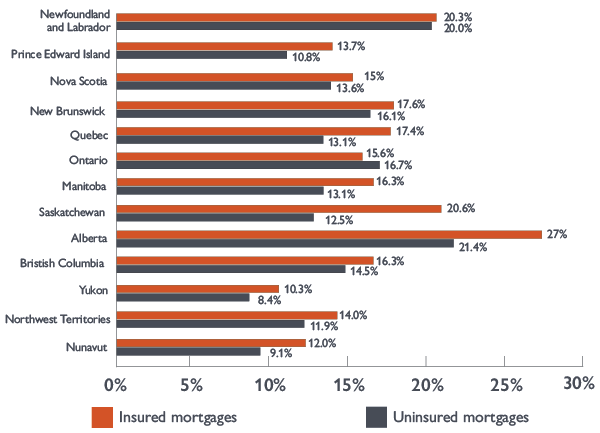

The share of insured and uninsured mortgages in the total outstanding mortgage balance varied by region. So did the deferral rate, calculated as the mortgage balance in deferral as a share of the total outstanding balance. Figure 2 shows the deferral rates for insured and uninsured mortgages as at June 30, 2020. The deferral rate was higher for insured mortgages in all the provinces and territories, except Ontario.

Figure 2. Share of balance in deferral for insured and uninsured mortgages varied by province and territory

| Geography | Insured mortgages | Uninsured mortgages |

|---|---|---|

| Newfoundland and Labrador | 20.3% | 20.0% |

| Prince Edward Island | 13.7% | 10.8% |

| Nova Scotia | 15.0% | 13.6% |

| New Brunswick | 17.6% | 16.1% |

| Quebec | 17.4% | 13.1% |

| Ontario | 15.6% | 16.7% |

| Manitoba | 16.3% | 13.1% |

| Saskatchewan | 20.6% | 12.5% |

| Alberta | 27.0% | 21.4% |

| British Columbia | 16.3% | 14.5% |

| Yukon | 10.3% | 8.4% |

| Northwest Territories | 14.0% | 11.9% |

| Nunavut | 12.0% | 9.1% |

Source: CMHC calculations using Equifax Canada data

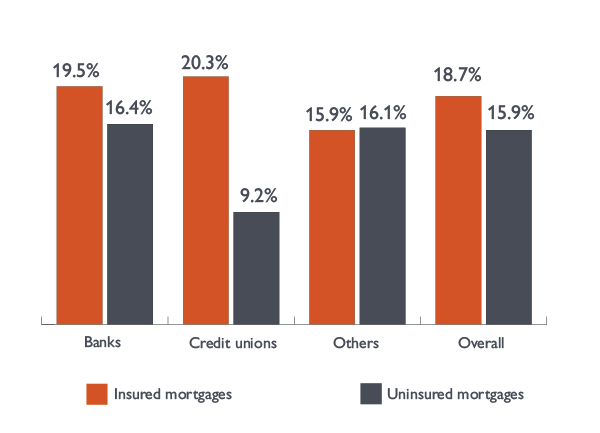

For banks and credit unions, insured mortgages accounted for a smaller portion (25.3%) of all residential mortgages that they held than did uninsured mortgages. A greater share of insured mortgages outstanding balance was deferred than for uninsured mortgages.

Deferrals of insured mortgages

- 19.5% for banks

- 20.3% for credit unions

Deferrals of uninsured mortgages

- 16.4% for banks

- 9.2% for credit unions

Among other lenders2, the share of insured mortgages deferred was similar to the share for uninsured mortgages. Both were close to 16.0% as shown in figure 3. A greater proportion of the mortgages held by these other lenders was insured rather than uninsured. That means they can be less likely than banks and credit unions to experience losses if borrowers of deferred mortgages default after the deferral period ends.

Figure 3. Share of balance in deferral for insured and uninsured mortgages varied by lender group

| Insured mortgages | Uninsured mortgages | |

|---|---|---|

| Banks | 19.5% | 16.4% |

| Credit unions | 20.3% | 9.2% |

| Others | 15.9% | 16.1% |

| Overall | 18.7% | 15.9% |

Source: CMHC calculations using Equifax Canada data

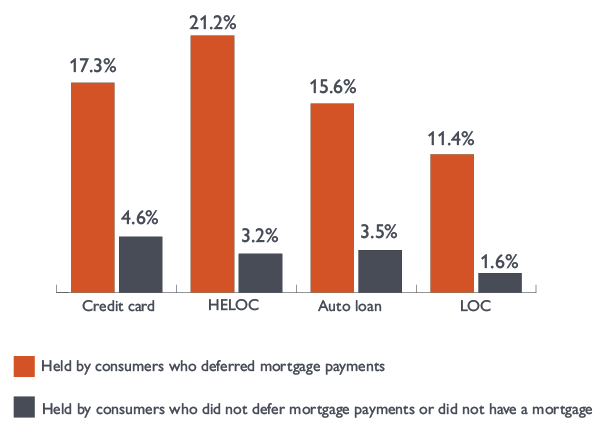

The majority of consumers with mortgages held credit card accounts. Many of them also held:

- personal lines of credit (LOCs)

- auto loans

- home equity lines of credit (HELOCs)

The concurrent deferrals in both mortgage and non-mortgage consumer debt indicate the severity of the financial difficulties faced by these borrowers. In figure 4,

- for credit card debt held by consumers3 who deferred mortgages, 17.3% of the outstanding credit card balance was in deferral.

- for HELOCs held by consumers4 who deferred mortgages, 21.2% of the outstanding HELOC balance was in deferral.

The deferrals in non-mortgage consumer debt were lower for people who did not defer mortgage payments or did not have a mortgage.

Figure 4. Share of non-mortgage consumer debt balance in deferral was higher for consumers who deferred mortgages than those who did not

| Held by consumers who deferred mortgage payments | Held by consumers who did not defer mortgage payments or did not have a mortgage | |

|---|---|---|

| Credit card | 17.3% | 4.6% |

| HELOC | 21.2% | 3.2% |

| Auto loan | 15.6% | 3.5% |

| LOC | 11.4% | 1.6% |

Source: CMHC calculations using Equifax Canada data

As at March 31, 2021, the total mortgage balance in deferral had decreased by 95.9% from its peak in June 2020. The total non-mortgage consumer debt balance in deferral had decreased by 96.5% during the same period.

Footnotes

- CMHC did not access or receive personal identifiable information on individuals in producing this report. All figures are sourced from Equifax Canada unless otherwise stated. Unless otherwise noted, dollars are not adjusted for inflation. Equifax data is as reported to that credit rating agency. The data may be revised at a later date due to Equifax data updates.

- In the Equifax data, the “other” group includes other monolines, personal finance companies, sales finance companies and all other financial services companies not already captured.

- The consumers were primary holders of both the mortgage and the national credit card accounts.

- The consumers were primary holders of both the mortgage and the HELOC accounts.

Share via Email

Share via Email