We talked to over 4,000 people from across Canada – our largest and most comprehensive survey yet!

Discover what consumers are thinking when it comes to buying a home

Access these insights and much more

-

Detailed consumer profiles broken down by buyer type!

-

A closer look at the lender and broker experiences during the homebuying journey.

-

New for 2023 Insights into the reasons homebuyers decide to renovate – with a feature on greener homes.

Here’s a preview of what you’ll find in the report

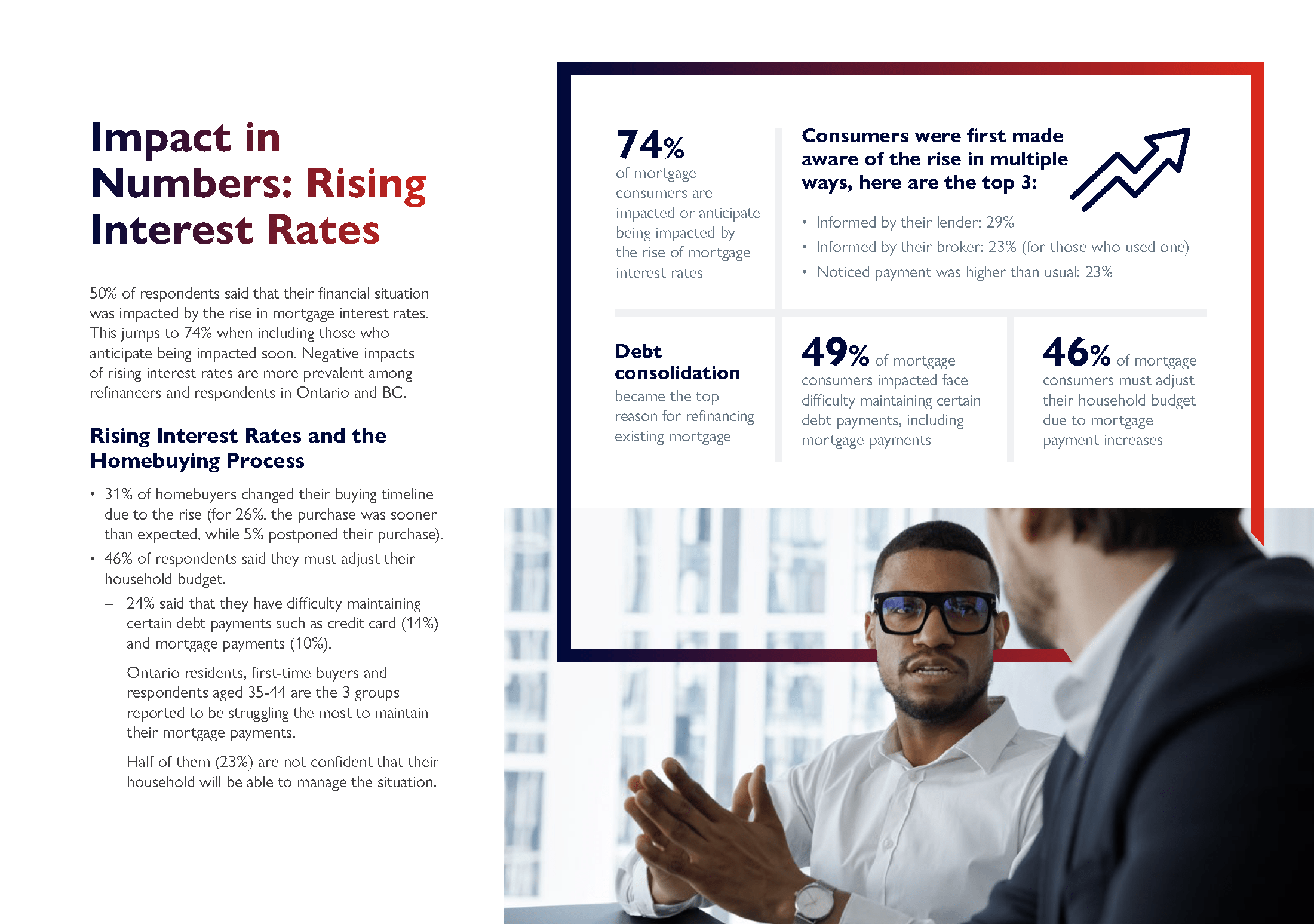

Impact in Numbers: Rising Interest Rates

50% of respondents said that their financial situation was impacted by the rise in mortgage interest rates. This jumps to 74% when including those who anticipate being impacted soon. Negative impacts of rising interest rates are more prevalent among refinancers and respondents in Ontario and BC.

Rising Interest Rates and the Homebuying Process

- 31% of homebuyers changed their buying timeline due to the rise (for 26%, the purchase was sooner than expected, while 5% postponed their purchase).

-

46% of respondents said they must adjust their household budget.

- 24% said that they have difficulty maintaining certain debt payments such as credit card (14%) and mortgage payments (10%).

- Ontario residents, first-time buyers and respondents aged 35-44 are the 3 groups reported to be struggling the most to maintain their mortgage payments.

- Half of them (23%) are not confident that their household will be able to manage the situation.

- 74% of mortgage consumers are impacted or anticipate being impacted by the rise of mortgage interest rates.

-

Consumers were first made aware of the rise in multiple ways, here are the

top 3:

- Informed by their lender: 29%

- Informed by their broker: 23% (for those who used one)

- Noticed payment was higher than usual: 23%

- Debt consolidation became the top reason for refinancing existing mortgage.

- 49% of mortgage consumers impacted face difficulty maintaining certain debt payments, including mortgage payments.

- 46% of mortgage consumers must adjust their household budget due to mortgage payment increases.

Get the report and join our CMHC Housing Updates mailing list

Was this page relevant to your needs?

Date Published: May 10, 2023

Share via Email

Share via Email