Speaking Notes for Evan Siddall, President and Chief Executive Officer, Canada Mortgage and Housing Corporation

Northwind Professional Institute

Housing Finance Forum

Langdon Hall

Cambridge, Ontario

Check against delivery

Introduction

Thank you; it’s a pleasure to be here. I had the privilege of speaking at Northwind’s inaugural Housing Finance Forum last February. Last year, I focused my remarks on CMHC’s transformation journey, specifically as it relates to our goal of being a world leader in housing risk management. As a systemically important financial institution, risk management will always be crucial to CMHC: it is at the core of our mandate to support the stability of Canada’s financial system.

There is another important side to our mandate, however. CMHC is also called upon to facilitate access to housing for Canadians – all types of housing, in all parts of the country, in good times and bad, and for people from all walks of life, including those with limited financial means. And as I’ve said elsewhere, we can use housing to help our most vulnerable citizens and, in so doing, build a more inclusive society.1

As I hope to demonstrate this evening, the two sides of our mandate are not as oppositional as some may believe. On the contrary, access to suitable, affordable housing limits risks to economic growth and fosters inclusive, cohesive communities. I will go even further. By enabling Canadians to access jobs that make the best use of their skills and ideas, a balanced housing market promotes long-term economic growth. It is essential that we provide responsible access, however, and not add to housing demand in a way that worsens affordability.

Investment in human capital – in innovation and talent – is key to long-term growth. We need to ensure that all Canadians can make the most of their skills and imagination, and many of these jobs are in our leading cities. No one should be deterred from pursuing a job that will maximize their contribution to society and the economy simply because suitable housing is unavailable, or housing costs are unaffordable in those cities. Addressing this challenge is central to CMHC’s raison d’être.

Last fall, the Government of Canada unveiled the country’s first National Housing Strategy, an ambitious 10-year, $40-billion plan to ensure that Canadians have access to housing that meets their needs and that they can afford. It includes the noteworthy adoption of a “right to housing,” underscoring just how fundamental shelter is. The Strategy is national in scope: its reach will be felt in the smallest, most remote communities in our country, as well as large urban centres. This evening, I’m going to focus on how housing can support – or encumber – the development of global cities in Canada.

Global Cities: Centres of Innovation and Wealth Creation

A.T. Kearney, a leading global management consulting firm, has been tracking data on the world’s most important cities for the past decade. According to its most recent global cities report, which examined 128 urban centres, three Canadian cities rank in the top 35 in the Global Cities Index: Toronto, Montréal and Vancouver.2 Toronto and Vancouver rank in the top 25 in terms of “outlook,” or potential for future competitiveness.3 And when referring to these cities, I am, of course, speaking about their greater metropolitan areas, not just the cities proper.

This is good news for Canada – we need global cities to support continued economic growth and prosperity. Global cities are increasingly becoming centres of innovation, skill and wealth creation, enmeshed in international flows of information, trade, technology and finance.4 They are cultural hubs, centres for inbound immigration and knowledge centres.5

Global cities tend to have high livability standards and low crime rates relative to other urban centres. They boast the amenities that a well-to-do citizenship demands: arts, theatre, higher education, high-end retail and fashion, world-class entertainment.6

Global cities also offer connectivity. They are transportation hubs, with large airports and transit systems that connect us with other urban centres, other markets and other global cities. They accommodate worker mobility – including, importantly, transient knowledge workers who move freely and frequently from one city or country to another, from one opportunity to the next.

If you accept my premise that the responsible development of global cities is good for our economy, how do we proactively support their continued evolution in Canada? And what role does housing play?

Housing: Part of a City’s Infrastructure

All of the factors I just mentioned make global cities substantial contributors to national economies – and certainly Toronto and Vancouver fit the definition in this regard. They are poles of attraction for Canadians seeking employment and immigrants seeking new and better lives. While this population growth and the formation of new households feed economic growth, they also increase the need for housing.

Housing is therefore part of the critical infrastructure necessary to foster the development of global cities – every bit as vital as airports, roads, public transit systems and other must-haves for vibrant, growing urban centres. Our National Housing Strategy acknowledges exactly this fact.

Quite simply, people need homes. And not just highly-paid knowledge workers and other middle-class Canadians. Strong economies rely on a diverse workforce, from those delivering products bought on-line to restaurant workers, cab drivers, retail and administrative staff … the list goes on. All of these workers indirectly support innovation and economic growth, and they all need affordable places to live. It is at the most vulnerable citizens – those least likely to be included in social activity – that we have directed our focus with the National Housing Strategy.

Conversely, a shortage of housing, or the wrong housing mix, can strangle a city’s growth. Rigidity of supply only serves to drive housing costs higher. This is a simple yet crucial observation. As American economist Joseph Gyourko has pointed out, “High prices always reflect the intersection of strong demand and limited supply.”7

The dynamics of the global economy are such that highly paid knowledge workers need to move quickly to where their skills are in demand and are suitably rewarded, and mobility is also increasing for less skilled workers. With workers having to move from city to city or within cities to secure their ideal job, mobility is on the rise. Ensuring that the housing market does not impede this mobility will therefore be critical if cities like Toronto, Montréal and Vancouver are to achieve their growth potential.8

A shortage of purpose-built rental housing, for example, can make it harder for workers to find homes near their preferred jobs. It also, inevitably, pushes monthly rent costs higher. This makes it difficult for those at the lower end of the income range to find affordable homes and encourages more middle-income households to enter the homeownership market – perhaps taking on more debt than they can realistically afford. As more buyers enter the market – and supply remains static – the price of homes will only continue to go up.

One potential solution to ease this transition is a form of “last month’s” rent insurance for certain types of tenants. Our team is examining if we can provide this kind of help.

A study published by the National Bureau of Economic Research in Cambridge, Massachusetts, concluded that, at some point, the snowball effect that supports the growth of global cities – whereby more innovation attracts more investment and more skilled workers, who in turn drive further innovation – will start to dissipate when housing costs become a barrier to migration.9

San Francisco is a good example of a global city that may be facing such a scenario. In a recent opinion piece published in The New York Times, Enrico Moretti, a professor of economics at the University of California (Berkeley) and one of the researchers involved in the study I just mentioned, drew attention to what he calls a “wildly inadequate” supply of housing in an area that is currently a magnet for skilled workers. And he blames this shortage primarily on slow and cumbersome housing approval processes and stringent land-use restrictions.”10 This is a frightening prospect for us in Canada.

Some are benefiting from this market imbalance – notably homeowners whose assets keep appreciating. That represents a further wealth transfer from renters or those looking to enter the homeownership market. In fact, research by Matthew Rognlie at MIT suggests that post-war income and wealth inequality is “driven almost entirely by housing.”11

Although Moretti’s article does not delve into this aspect of the problem, the deeper research he has done with his colleagues suggests that not only are businesses in the San Francisco area not benefitting from the shortage of housing, nor is the broader U.S. economy, as it is deprived of technologies that might have been developed there.

The high cost of living is likely causing some talented workers to leave, and dissuading others from taking jobs in the Bay Area in the first place. Businesses themselves may be locating – or relocating – to areas where housing is more affordable for their workers.12 I know myself of business leaders in Vancouver considering relocating their head offices to attract more workers.

High house prices alone should not be indicators of a global city – this is not the first thing we want people to think of when considering a move for employment reasons. Nor do we want a shortage of housing to constrain economic growth by deterring talent from in-migrating and staying.

As I noted a moment ago, to be sustainable and livable, global cities need a broad spectrum of housing – from shelters for the homeless to community-based units to luxury condominiums. Importantly, a significant proportion of housing – whether rental or owned – needs to be affordable to middle and lower-income residents who help make these cities run.

A Call to Action: Co-ordinated Supply Efforts

The question is: how are Canada’s global cities faring in this regard? Do they have an adequate supply of housing to sustain their development in the longer term?

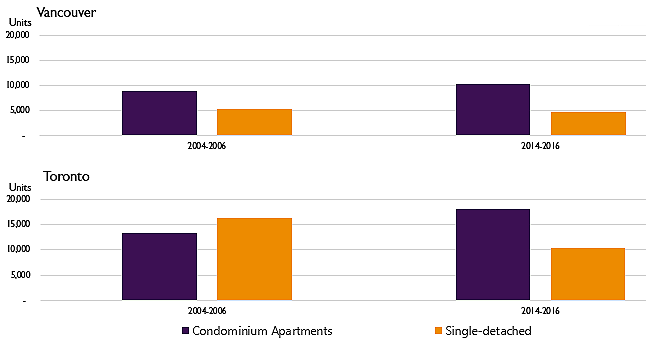

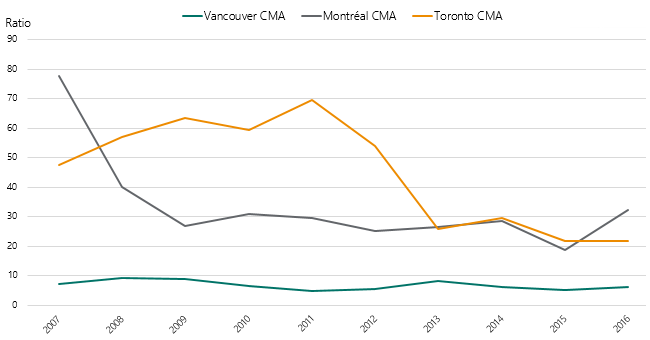

As part of our efforts to better understand Canadian housing markets, and specifically why house prices in Vancouver and Toronto continue to escalate, CMHC has undertaken extensive research on housing markets in our leading cities, looking at both supply and demand.13 Our report on this work was released earlier today, and represents the most thorough examination of house price patterns ever completed in Canada. On the demand side, it confirms that patterns of economic and population growth, together with lower mortgage rates, account for a substantial part of price growth in Canadian cities. But importantly, we also found that the supply response to price increases has been significantly weaker in Toronto and Vancouver than in other Canadian cities.

Source: CMHC

Before the finger pointing begins, we don’t fully know why this is the case. We are hampered by incomplete data, and need to work more closely with other jurisdictions to understand what is happening. We intend to do that, but in the meantime we are taking action to help.

As policy makers, we must avoid further stimulating demand and focus our energy on encouraging housing supply.

National Housing Strategy: Return of the Federal Government

In our view, a concerted effort is needed to increase housing supply across the spectrum of affordability. And by concerted I mean an effort that involves all levels of government, as well as the private and not-for-profit sectors. An effort that involves a fundamental re-thinking of land use planning, zoning and development, as well as the de-stigmatization of renting. Rent or own, it is still a home.

Our new National Housing Strategy provides a framework for increased collaboration and joint initiatives across the housing system. It is unapologetically a supply-oriented strategy, with the specific targets of removing 530,000 households from housing need, repairing 300,000 existing affordable housing units and investing in the construction of up to 100,000 new homes over the next decade.

In addition to supporting the most vulnerable groups in society – which is our primary objective – this approach will enable increased labour mobility by ensuring a greater supply of housing for low- and middle-income workers so that they can move closer to the jobs they want.

Through the new National Housing Co-investment Fund, for example, CMHC will make as much as $16 billion available over 10 years in loans and contributions to enable other levels of government and the private and not-for-profit sectors to build new affordable housing, preserve the existing affordable housing supply, and develop new housing solutions.

This represents our primary financial contribution to new housing supply. Through this Fund, we expect to create up to 60,000 new units of housing and repair up to 240,000 units of existing affordable and community housing. We are also supporting increased supply through the Rental Construction Financing Initiative, which is providing low-cost loans to municipalities and housing developers during the earliest and riskiest phase of rental property development.

To maximize the impact of the Co-Investment Fund, over the next 10 years the Government of Canada will transfer up to $200 million in federal lands to community and affordable housing providers, to encourage the development of sustainable, accessible, mixed-income and mixed-use communities. It was recently suggested that only cities are offering surplus land; we are doing our part too. Starting later this year, we will also provide funding for renovations, retrofits and environmental remediation to ensure that surplus federal buildings are suitable for use as housing.

Densification and a Focus on Rental Housing

Increasing the supply of affordable rental housing is key to supporting the growth of world-class cities – but it is only part of the answer. We also need to increase the supply of market-oriented housing, for both the rental and ownership markets. Doing so will lead to balanced markets, promote financial stability and support business and economic growth.

As I have already noted, the supply response has been weak in Toronto and Vancouver. While condominiums starts have gone up, starts of single-detached housing have not. And, as is inevitable with limited supply, the price of single-detached housing has continued to rise.

We have to ask ourselves, as a society, if this is somewhat inevitable. If we look to the examples of many other global cities, the answer is yes. Environmental and fiscal pressures, together with other factors such as geographical constraints, are pulling our big cities toward denser living and a lower supply of single-detached housing. We need to manage this transition effectively, to avoid stumbles along the way that could impede economic growth, including the ongoing risk that homebuyers will take on unmanageable levels of debt in their quest of the Canadian dream of owning a single-detached home.

How municipalities and developers go about building our cities is becoming increasingly important. In our view, densification is crucial. On this metric alone, Canadian cities have a long way to go to catch up to other global cities. Metropolitan Vancouver and Toronto average about 486 people per square kilometre. New York City, by comparison, has close to 1,700 people per square kilometre, London has almost 1,800 and Tokyo close to 4,200.14

Most urban Canadians support densification – as long as it is happening in someone else’s neighbourhood, that is. In practice, the concept is fraught with friction and roadblocks. Municipal planners and politicians are often caught between the desire of developers to build “up,” in order to make their projects economically viable, and the determination of local residents to maintain the character of their neighbourhoods and, in their minds, the value of their property. Since building houses is inevitable, we have to choose between building horizontally – urban sprawl – or vertically – densification.

We can understand both sides of the argument – but the current approach puts our economic future at risk and is environmentally regressive. Simply building single-detached housing out beyond the suburbs is no longer feasible. Urban sprawl and the construction of large homes on large lots come at high costs not only for the homebuyer, but for governments, the environment and our society.15

The impact goes beyond just housing. It means more roads and sewers need to be built and maintained, placing a heavy burden on municipal governments and ratepayers. More vehicles spewing greenhouse gases and other pollutants into the air; longer commute times for workers; the loss of productive farmland or encroachment into environmentally sensitive areas; and lost time for leisure, families and social connectivity.

Recognizing the problem, we have to be deliberate in how we address it. More regulations or higher development fees that restrict housing supply in city centres will push homeowners out to the suburbs and increase pollution. As American urban economist Ed Glaeser pointed out, rental properties in the U.S. tend to be located in large, multi-family structures, which in turn tend to be associated with greater density and less pollution.16

Towards a Comprehensive Federal Housing Strategy

All of this calls for a more comprehensive approach to housing development. All levels of government – including the federal government – need to be involved, working together to increase housing supply and create inclusive communities where people want to live and work; where jobs, daycare, schools and medical facilities are nearby. Communities ought to be where people feel a sense of belonging, whether they rent or own. Through our National Housing Strategy, the Government of Canada has bought its ticket to the party.

We also need to involve builders and developers: we have to design our cities to not only be denser but also liveable. As I’ve noted, increased supply of condos in cities like Toronto and Vancouver is desirable, but these are not the only types of homes that are needed. They are perfectly fine for many households, but not for everyone.

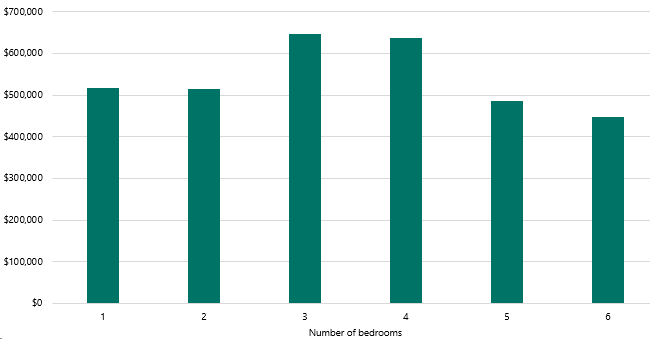

In our analysis of the housing market in Vancouver, for instance, we found a sharp jump in price when moving from a two- to a three-bedroom home. Obviously some of this price difference is because three-bedroom homes are usually single-detached houses, but does this have to be the case? Why are we not building more three-bedroom condos or other types of denser housing – duplexes, triplexes and so on – to meet this need? Can we meet the demand for more living space by renovating our housing structures, rather than by expanding our urban boundaries?

Source: BC Assessment

It’s not all on builders and developers – although developer land banking, pre- and post-rezoning, is supply regressive too. As governments, we need to find more efficient ways to rezone and redevelop under-utilized properties, and fashion simpler, more flexible approval processes. And yes, we need to reconsider rent-control policies, development charges, property tax regimes, rezoning and user-pay principles. We need to stop these easy games of blaming each other and passing the buck.

Short of blaming, we also need to face facts and work together to solve problems. In her book Perverse Cities: Hidden Subsidies, Wonky Policy, and Urban Sprawl, urban planner Pamela Blais argues that the combination of fees and charges levied by governments subsidizes sprawl.17 We took a look at the numbers with the help of consultants. While we had to make a number of assumptions to develop a view of this, our scenarios suggest that, in the GTA, higher-density developments face higher non-federal charges than low-density development. This is effectively a tax on density. And along with industrial lands crowding out residential development, rezoning fees that are linked to land price gains just increase the cost of housing. In Greater Vancouver, redevelopments of property face higher non-federal fees than new development.

Montréal, on the other hand, has far lower development costs and fees than Vancouver and Toronto. It also takes less time to approve projects in Montréal,18 and the city is moving to redevelop its old industrial lands towards housing. From an affordability point of view, Montréal has taken a particularly sensitive approach.

| New Development Scenario | Redevelopment Scenario | |||||

|---|---|---|---|---|---|---|

| Density: | Low | Med | High | Low | Med | High |

| Average charges per unit | Dollars per unit | |||||

| Greater Toronto | 100,900 | 80,400 | 62,800 | 58,500 | 57,900 | 56,300 |

| Greater Vancouver | 86,700 | 48,500 | 23,200 | 105,800 | 63,300 | 31,400 |

| Greater Montréal | 18,100 | 12,800 | 7,100 | 18,500 | 12,900 | 7,100 |

| Average charges per square foot | Dollars per square foot | |||||

| Greater Toronto | 40 | 45 | 70 | 23 | 32 | 63 |

| Greater Vancouver | 35 | 27 | 26 | 42 | 35 | 35 |

| Greater Montréal | 7 | 7 | 8 | 7 | 7 | 8 |

| Average charges as per cent of sales price | Per cent | |||||

| Greater Toronto | 7.4 | 9.6 | 11.1 | 4.2 | 6.9 | 10 |

| Greater Vancouver | 3.6 | 4.9 | 3.5 | 4 | 5.4 | 4.5 |

| Greater Montréal | 3 | 3.1 | 2.6 | 3.1 | 3.2 | 2.6 |

Source: Altus Economic Consulting

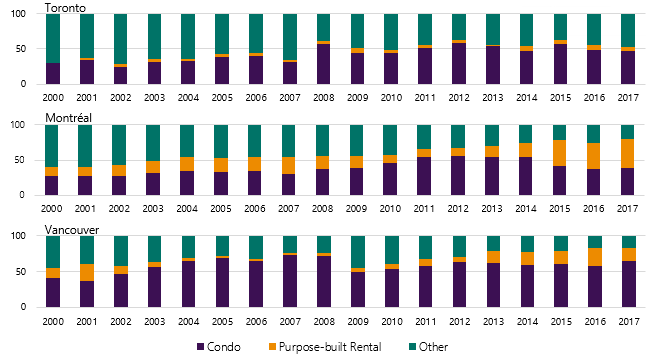

Interestingly, the rental market in Montréal is far more robust than in the other two cities. The stock of privately owned rental apartments in Montréal is proportionately much larger than in Toronto and more than three times higher than in Vancouver.19

Source: CMHC Starts and Completions data

Notes: Data based on CMHC calculations from Statistics Canada Census.

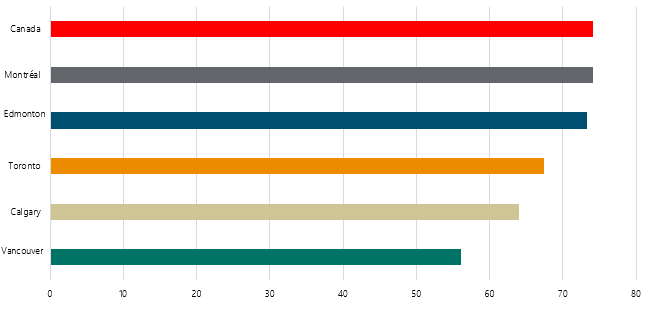

Source: Census 2016 98-400-X2016226

We also have to be careful with policies in the rental sector that could adversely affect supply. Clearly, we need to protect renters from being exploited, but how we do that matters. Again turning to that mecca of innovation, San Francisco, new research from Stanford University found that rent controls, while protecting current inhabitants, actually lowered the supply of rental properties and would discourage future inhabitants from moving there.20 Any economist will tell you that rent controls are politically expedient but poor housing policy, only disincentivizing maintenance and new supply.

And we also know that we are replacing homes at too slow a rate in Toronto and Vancouver. In Montréal, around 30 houses are built for every one that is demolished. In Toronto, we build only 20, and Vancouver’s replacement ratio is less than 10 to one.

Source: CMHC calculations based on Statistics Canada data

CMHC: National Housing Convenor

My point is simply this: it’s time to take a close and careful look at how we encourage — or indeed discourage — the development of our cities, global and otherwise. We need to start a dialogue on these issues, and it’s urgent.

How do we as governments work with each other – and also with developers and other stakeholders – to address barriers that could stifle the growth or our cities and economy? In urban areas like Vancouver that encompass several municipalities, how can we improve planning at a regional level on issues like infrastructure, housing and transit?

CMHC certainly does not have all the answers, and we recognize that the problems don’t lie with any one level of government. It’s not just about municipal fees and regulations nor provincial rent controls; we at the federal level need to look at our own policies and practices as well. We know, for example, that better data and analysis are needed to support policy development and decision making. This is something CMHC will be aggressively pursuing under the National Housing Strategy, along with a review of our own policies and practices that have starved supply.

I’m confident that the launch of the Strategy – and the national leadership role the Government of Canada is taking on housing – will open doors for dialogue and collaboration on many issues. In Toronto, Vancouver, Montréal and other cities across the country, we need to transform housing planning and development processes to make them quicker and more efficient, more innovative and more inclusive. This can only be achieved by working together, within and across governments, between developers and community associations, and in collaboration with developers and service providers.

CMHC will be taking a leadership role to make this happen. We will convene an annual National Housing Conference before year end, with housing supply and affordability being a key recurring theme. Because ultimately, while the goals of various players may differ, their achievement depends on ensuring that Canadians have a roof over their head and the chance to succeed, so that our communities can continue to prosper and grow, contributing to a strong economy and a quality of life that has deservedly made us the envy of the world.

CMHC will do its part. We will be working more closely than ever with our partners in the provinces and territories and with municipalities, housing providers and other stakeholders to ensure that the ambitious goals of the National Housing Strategy are met.

Harvard University recently posed the question, “Who is responsible for the future of cities?”21 I’d say it’s a trick question: we all are. And we owe it to our country to work more closely together.

Thank you.

As always, I am indebted to many colleagues for their contributions to these remarks. In addition to John Bissonnette, my co-author, I am particularly grateful to Aled ab Iorwerth for his excellent work on our house price study (see endnote 13), the foundation on which my comments rest.

1 Evan Siddall, 2017. “No Solitudes: A Canadian National Housing Strategy,” (speech to the Canadian Club of Toronto) 1 June 2017

2 Mike Hales, Erik Peterson, Andres Mendoza Pena, Nicole Dessibourg-Freer and Katherine Chen, 2017. Global Cities 2017: Leaders in a World of Disruptive Innovation, A.T. Kearney, 2017, p. 11.

3 Ibid., p. 2.

4 Gilles Duranton and Diego Puga, 2014, “The Growth of Cities,” Chapter 5 in Philippe Aghion and Steven Durlauf, eds., Handbook of Economic Growth, Volume 2b, Chapter 5, 2014.

5 Edward L. Glaeser, Jed Kolko and Albert Saiz, 2001. “Consumer City,” Journal of Economic Geography, Vol. 1, Iss. 1. January 2001

6 David Albouy, Fernando Leibovici and Casey Warman, 2013.“Quality of Life, Firm Productivity, and the Value of Amenities across Canadian cities,” Canadian Journal of Economics, Vol. 46, Iss. 2, May, pp. 379-411, 2013.

7 Joseph Gyourko, 2009. “The Supply Side of Housing Markets,” National Bureau of Economic Research Reporter: Research Summary 2009 Number 2, 2009.

8 This argument has been associated with Andrew Oswald of the University of Warwick in the U.K. An evaluation of the impacts in the Australian context was undertaken by the Australian Housing and Urban Research Institute. Stephen Whelan and Sharon Parkinson, 2017. Housing tenure, mobility and labour market behaviour, AHURI Final Report No. 280, Australian Housing and Urban Research Institute Limited, May 2017.

9 Chang-Tai Hsieh and Enrico Moretti, 2017. “Housing Constraints and Spatial Misallocation,” NBER Working Paper No. 21154, National Bureau of Economic Research, May 2017.

10 Enrico Moretti, 2017. “Fires Aren’t the Only Threat to the California Dream,” The New York Times, November 3, 2017.

11 Matthew Rognlie, 2015. “Deciphering the fall and the rise in the net capital share,” The Brookings Institution, Spring 2015.

12 Pater Ganong and Daniel Shoag, 2017. “Why Has Regional Income Convergence in the U.S. declined?,” Vol. 102, November, pp. 76-90, January 2015.

13 CMHC, Market Analysis Centre, 2018. Examining Escalating House Prices in Large Canadian Metropolitan Centres, February 2018.

14 Organization for Economic Co-operation and Development. The OECD has developed a methodology to look at population densities across countries, and therefore these figures may differ from those of Statistics Canada.

15 Edward L. Glaeser and Matthew E. Kahn, 2004. “Sprawl and Urban Growth,” in: J. V. Henderson and J. F. Thisse, (eds., Handbook of Regional and Urban Economics, Edition 1, Vol. 4, Chapter 56, pp. 2481-2527, ©Elsevier B.V. 2004.

16 Edward L. Glaeser, 2011. “Rethinking the Federal Bias Toward Homeownership,” Cityscape: A Journal of Policy Development and Research, Vol. 13, No. 2, pp. 5-37, U.S. Department of Housing and Urban Development, 2011.

17 Pamela Blais, 2011. Perverse Cities: Hidden Subsidies, Wonky Policy, and Urban Sprawl, UBC Press, 2011.

18 The Fraser Institute’s Regulatory Index, select cities, 2016.

19 Statistics Canada, 2016 Census.

20 Rebecca Diamond, Tim McQuade and Franklin Qian, 2017. “The Effects of Rent Control Expansion on Tenants, Landlords and Inequality: Evidence from San Francisco,” November 2017.

21 Carmen Nobel, 2017. “Who is responsible for the future of cities,” Harvard Business School Working Knowledge, 6 November 2017.

Share via Email

Share via Email